Near- and Non-Prime Consumer Update

Dec 11, 2023

Owning a vehicle opens many doors and is often the first step in building good credit. Vehicle ownership also creates onramps for a better quality of life.

Open Lending’s 2023 Vehicle Accessibility Report found that 64% of non-car owners felt their earning potential would increase if they had access to a vehicle, and more than half of non-car owners have had to turn down a better job or promotion due to not owning a car.

The challenges of vehicle affordability, from historically high retail prices to the cost of ownership brought on by the recent increases in the cost of auto insurance, all coupled with the Federal Reserve’s unprecedented rate increase campaign, are excluding a large sector of would-be car purchasers who fall outside the prime credit tier.

At Open Lending, we know how important it is to expand vehicle accessibility, particularly to those who fall outside of the prime credit segment. For over 20 years, we’ve been empowering automotive lenders to serve more near- and non-prime borrowers (those with a credit score between 560 and 699) by delivering AI-powered decisioning and cutting-edge technology and keeping a pulse on the market.

We consider conducting research and delivering regular insights to lenders critical to ensuring they can effectively include near- and non-prime borrowers in their portfolios.

In analyzing recent data on near- and non-prime consumer behaviors and lending habits, we’ve outlined some of the biggest trends automotive lenders should be aware of.

Automotive lenders who stay in-tune with near- and non-prime vehicle preferences and lending habits are better positioned to reach more borrowers with less risk and remain competitive in an increasingly crowded market. Open Lending’s latest Near- and Non-Prime Market Report looks at recent near- and non-prime market trends and provides critical insights to inform loan decisioning processes.

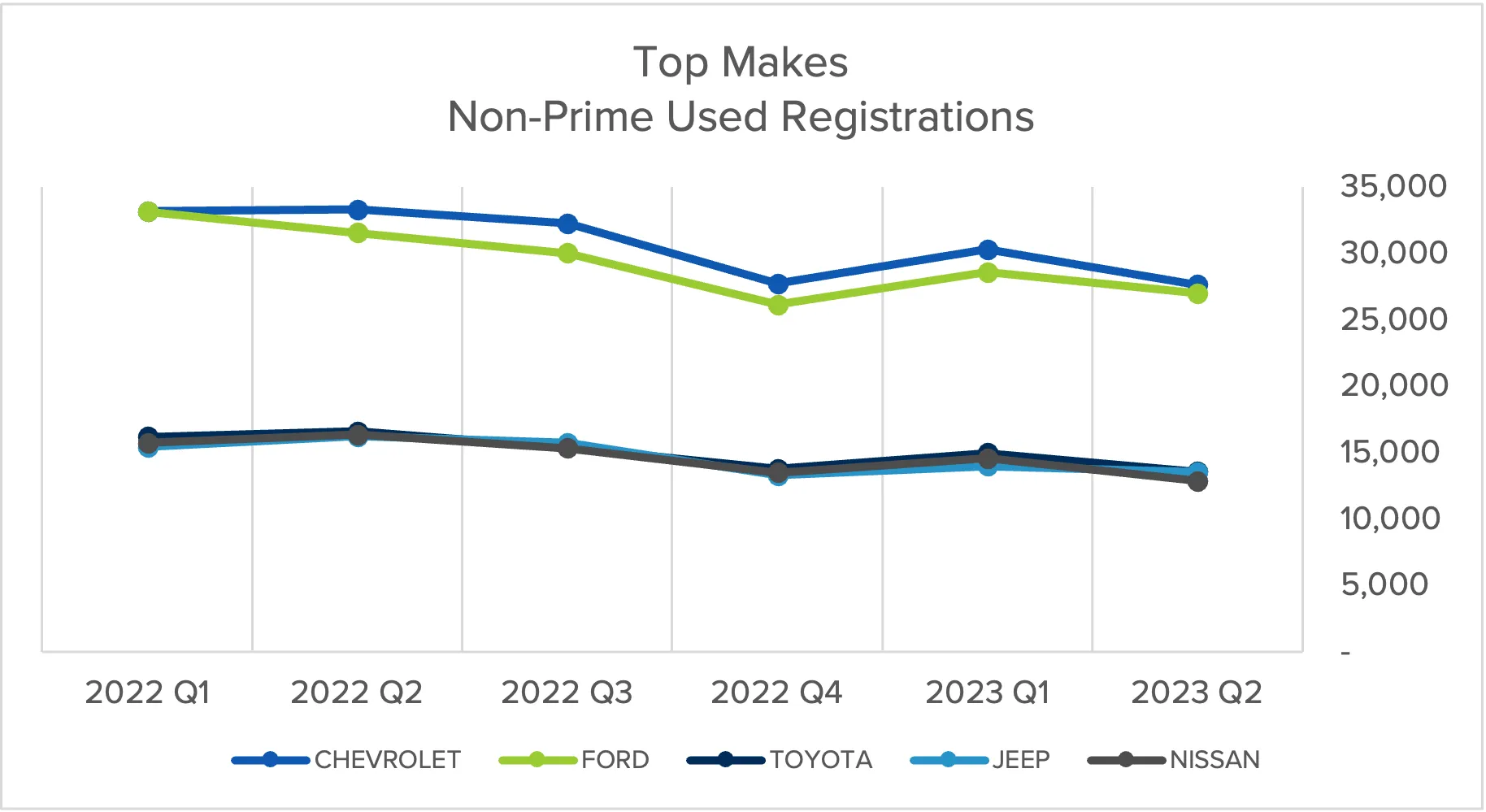

Used-car originations for near- and non-prime borrowers fell 33% year-over-year, compared to a 22% year-over-year decline for prime borrowers. Additionally, near- and non-prime automotive registrations declined with each interest rate increase throughout 2023. In the second quarter of 2023, near- and non-prime registrations fell by 7,000 for every basis point increase in the interest rate, while prime registrations were virtually unchanged.

In the second quarter of 2023, near- and non-prime borrowers purchased nearly the same amount of used Chevy and Ford vehicles. The number of sales of Chevy and Ford makes doubled the sales of Toyotas, Jeeps, and Nissans sold. Near- and non-prime consumers also purchased more new Chevy vehicles than other brands. About 6,500 were sold in the second quarter of 2023.

Near- and non-prime consumers purchased more used Ford F-150s than any other model in the second quarter of 2023, followed by the Chevy Silverado 1500. In new cars, consumers most often purchased Chevy Silverado 1500s, with over 1,550 sold during the second quarter of 2023. When analyzing popular vehicle types, near- and non-prime consumers prefer compact utility vehicles in a used car, while they prefer compacts and upper-mid-size vehicles for new cars. Electric vehicles (“EVs”) remain relatively elusive for near- and non-prime consumers. There has been a slight increase in near- and non-prime EV registrations in the second quarter of 2023, potentially signaling an attempt from EV manufacturers to reach beyond prime.

Read on to learn about all of our findings, including prime consumer preferences.

Near- and non-prime consumers are facing an uphill battle when trying to secure automotive financing compared with other credit tiers. According to Open Lending data, used-car originations for near- and non-prime borrowers fell 33% year-over-year. Comparatively, used-car originations for prime borrowers fell 22% year-over-year.

Source: Open Lending

While the Federal Reserve’s rate increases have impacted borrowers across credit tiers, those who fall below prime are disproportionately impacted when applying for automotive financing. Data from our soon-to-be-released 2024 Vehicle Accessibility Report found that 27% of near- and non-prime consumers said their interest rate is higher than expected, and 28% said their monthly payment is higher than expected, with over half reporting monthly car payments between $401-$800.

As interest rates continued to rise throughout 2023, each increase came with a dip in near- and non-prime automotive registrations. By the second quarter of 2023, near- and non-prime used registrations decreased by 7,000 for every basis point increase in the interest rate. On the other hand, prime registrations continue to rise steadily despite the rate increases.

Source: AutoCreditInsight™

The decrease seen in near- and non-prime originations and rising automotive loan rejection rates means a large swath of potential borrowers is being priced out of the market, which presents serious implications for the broader automotive financing industry. Without being approved for automotive loans, a critical component to building a solid credit history, near- and non-prime borrowers could be disqualified for financing future large purchases. Less eligible borrowers mean lenders will start to see profitability targets and loan volumes shrink as fewer and fewer borrowers qualify as prime.

Understanding the make and model preferences of near- and non-prime consumers is critical in making informed lending decisions, managing risk, and remaining competitive in an increasingly crowded market.

The types of cars consumers choose can give automotive lenders a more complete picture of a borrower’s financial stability and creditworthiness. For example, if near- and non-prime consumers are purchasing more affordable, reliable, fuel-efficient vehicles, it could indicate a greater likelihood of making on-time payments. Understanding near- and non-prime consumer preferences can also help lenders reduce their exposure to specific makes and models with higher default risk.

Open Lending has long understood the value of encompassing vehicle data into the loan decisioning process. Our Lenders Protection™ solution analyzes specific make and model data and incorporates it into our loan pricing to ensure lenders can provide the most accurate and informed price.

Chevy and Ford were virtually tied for most used cars sold to near- and non-prime consumers in the second quarter of 2023. The number of Chevys and Fords sold during this time was double that of Toyotas, Jeeps, and Nissans.

Source: Open Lending

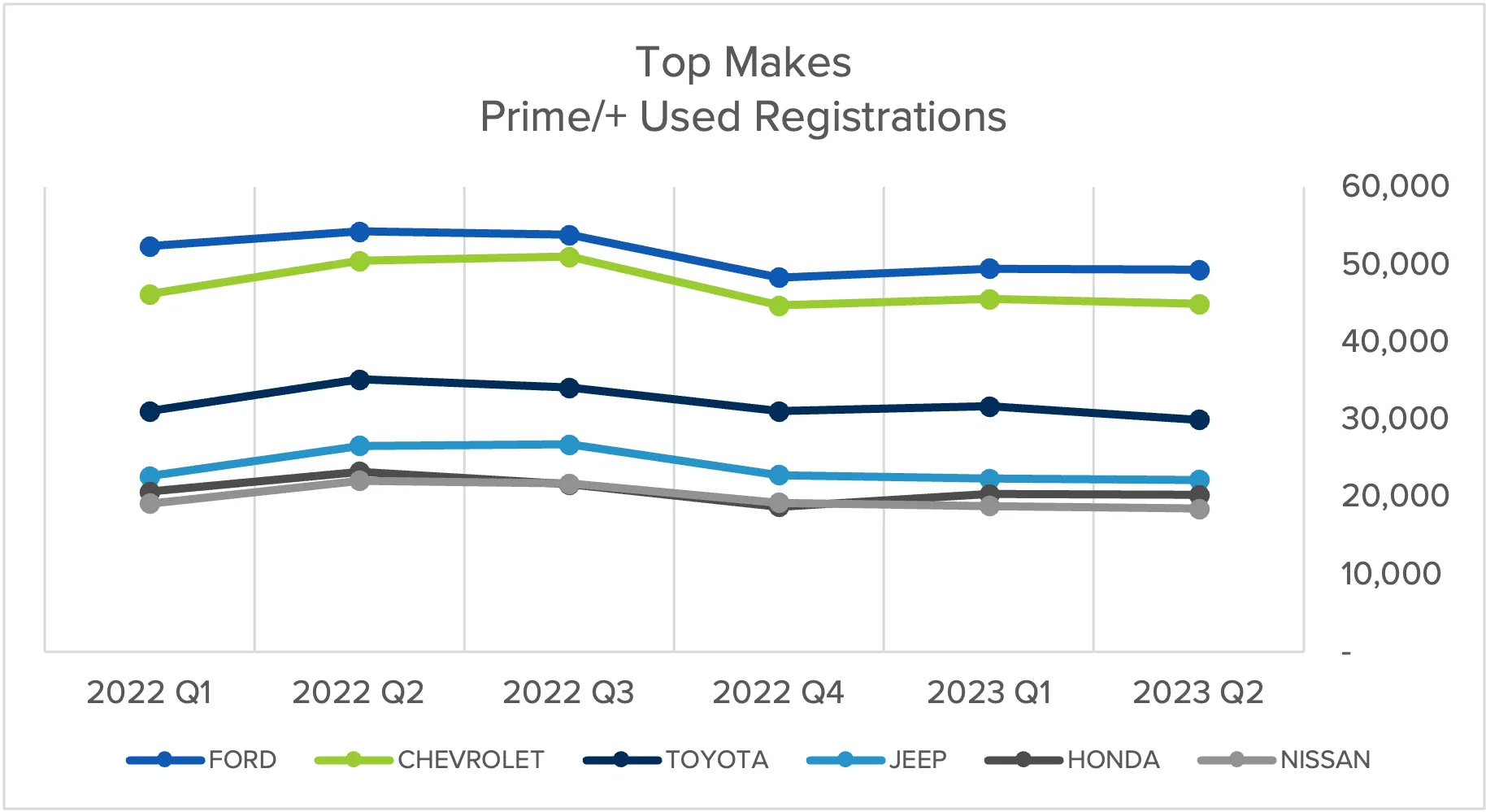

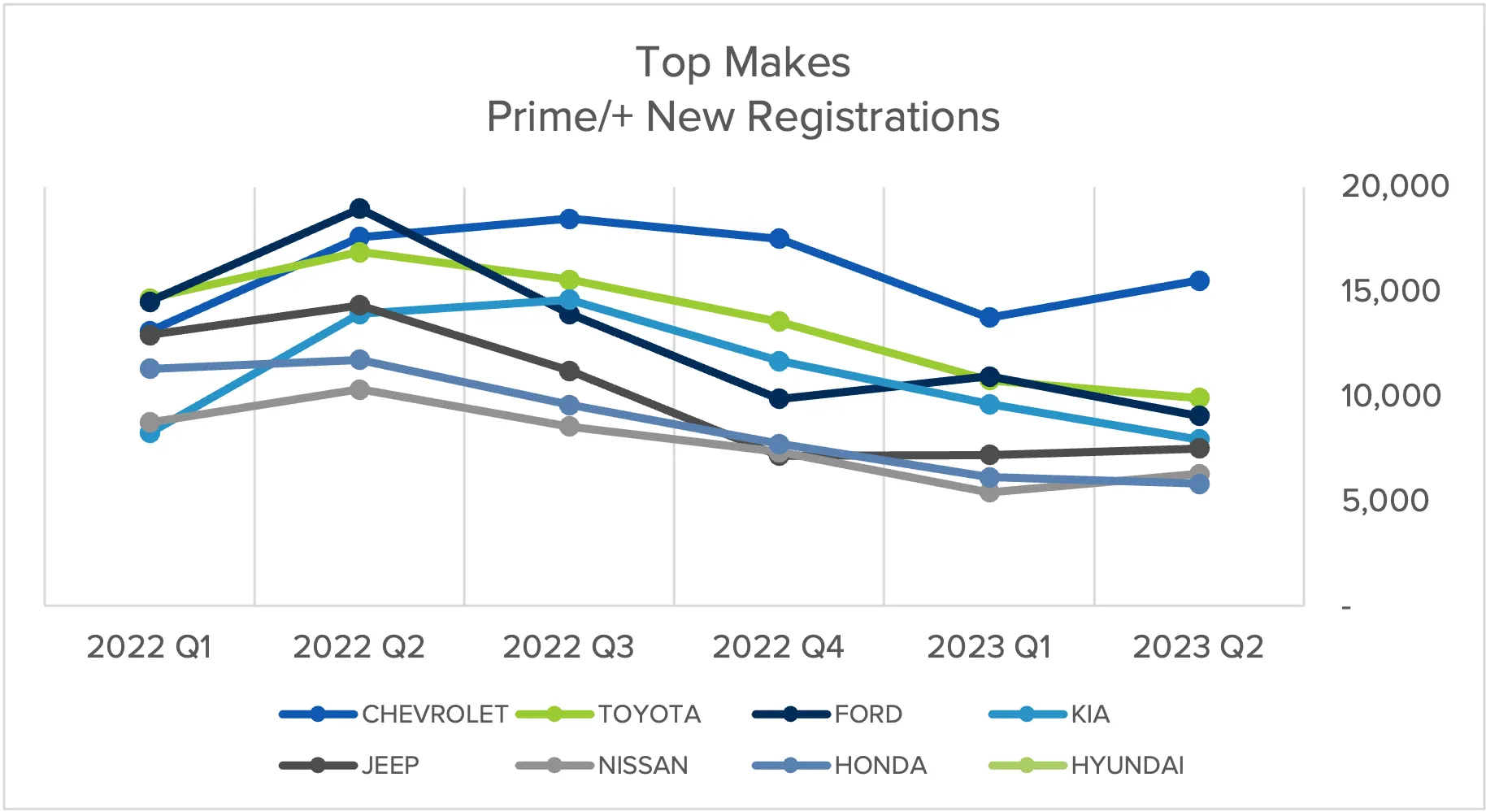

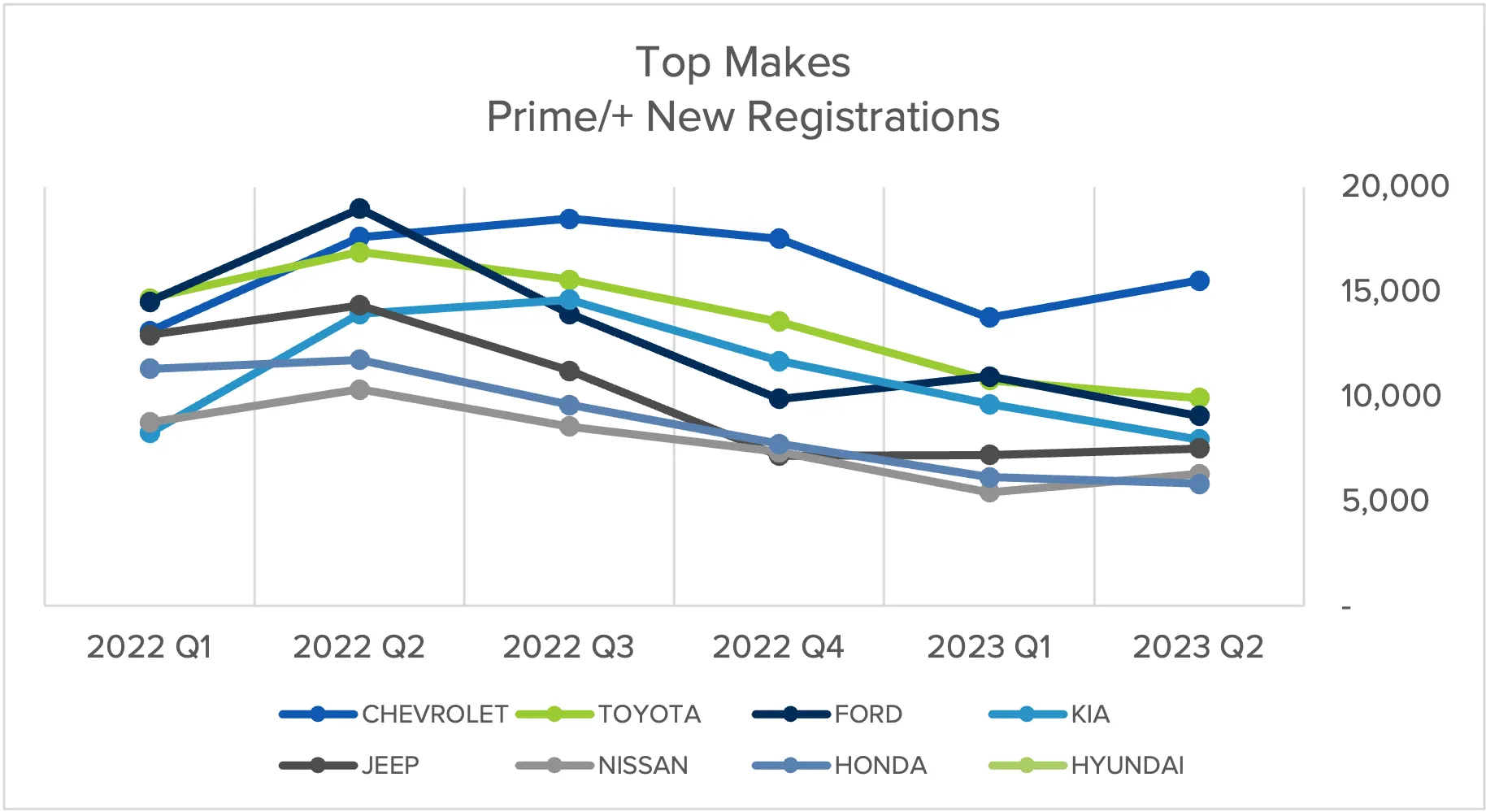

While prime consumers also purchased more Chevys and Fords — nearly 49,000 Fords and nearly 45,000 Chevys were sold in the second quarter of 2023 — the gap between the two makes was slimmer than it was for near- and non-prime consumers. Toyotas were the third-largest amount of makes sold to prime consumers, with nearly 30,000 sold in the second quarter of 2023.

Source: Open Lending

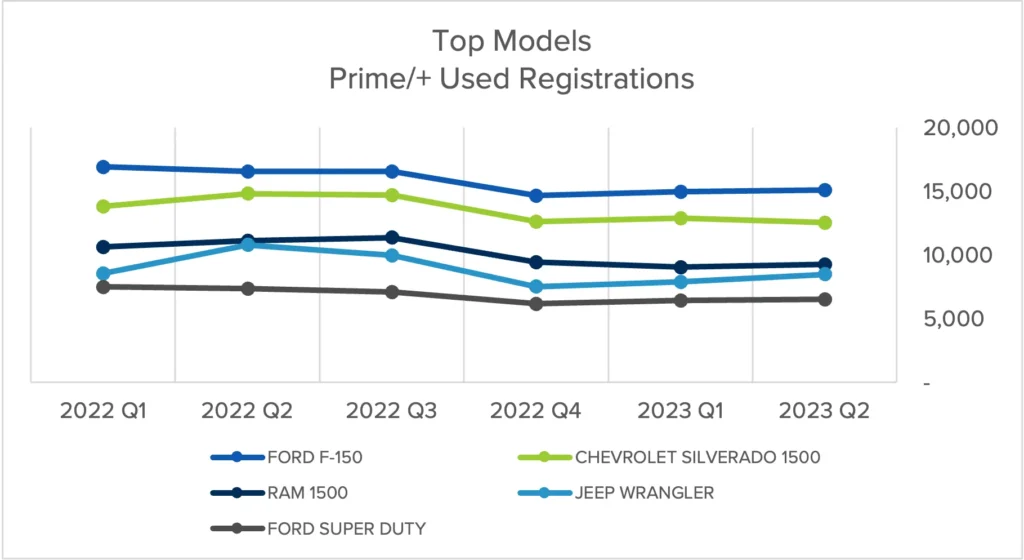

The Ford F-150 was the most popular model for near- and non-prime consumers, with the Chevy Silverado 1500 coming in at a close second. As we saw with the used make data for near- and non-prime consumers, Ford and Chevy were virtually tied. The Ram 1500 has remained a consistently popular choice for near- and non-prime consumers over the past year.

Source: Open Lending

The Ford F-150 and the Chevy Silverado 1500 are also the most popular used vehicles for prime consumers. However, there is a slightly wider gap between them, with prime consumers buying just over 15,000 F-150s in the second quarter of 2023 compared to just over 12,500 of the Chevy Silverado 1500.

Source: Open Lending

Near- and non-prime consumers primarily prefer compact utility vehicles. For prime consumers, full-size half-ton pickups and compact utility vehicles were nearly tied for the most used-car type sold. Across all credit tiers, used vehicle type preferences have remained relatively consistent year-over-year.

Source: Open Lending

These used car metrics and consumer preferences reflect broader market trends. It’s important for automotive lenders to stay informed about changing preferences or consistent demand for certain brands or features. Having this insight enables automotive lenders to adapt loan offerings to support consumer trends and behavior, attracting more borrowers and staying competitive.

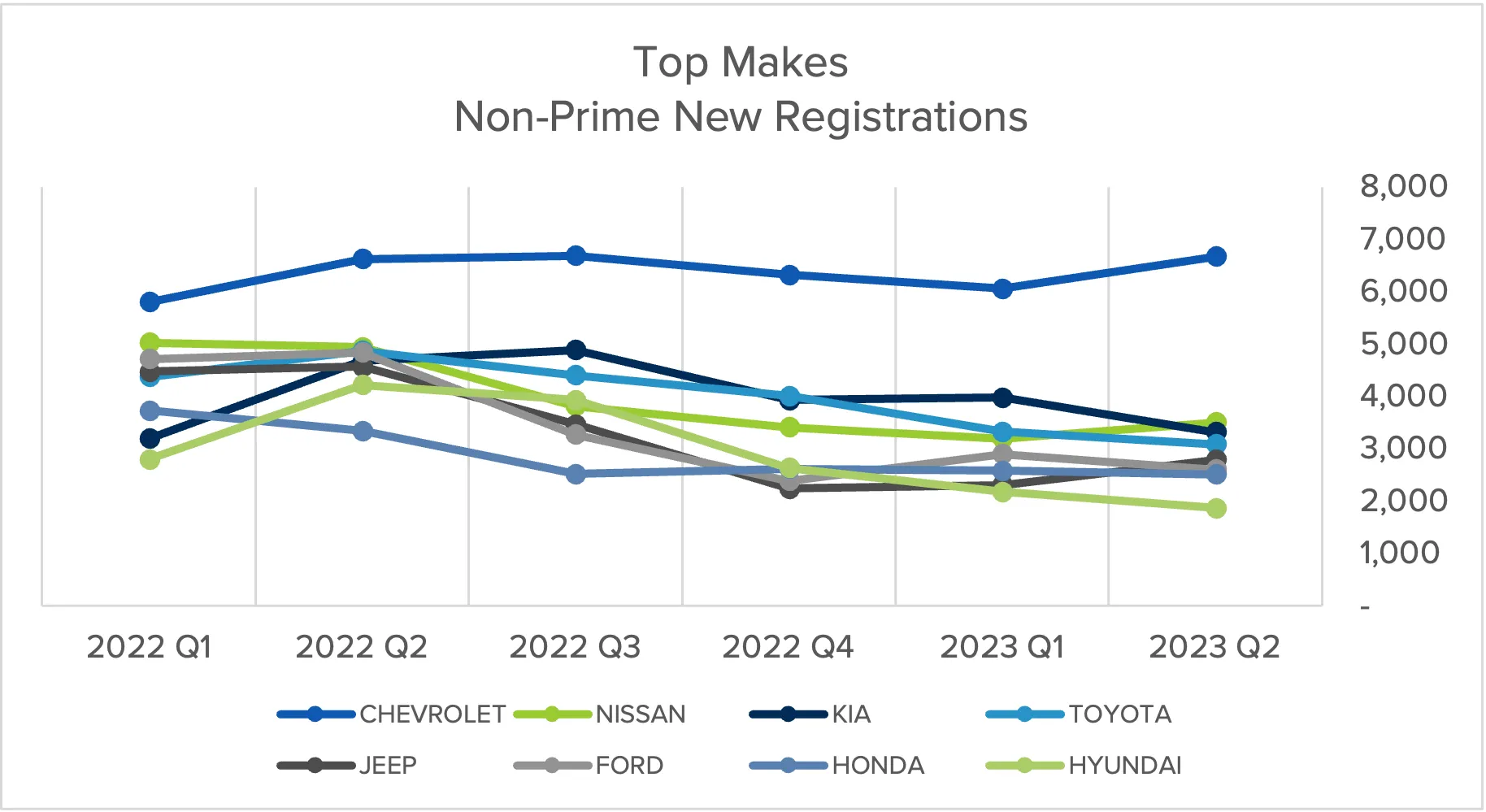

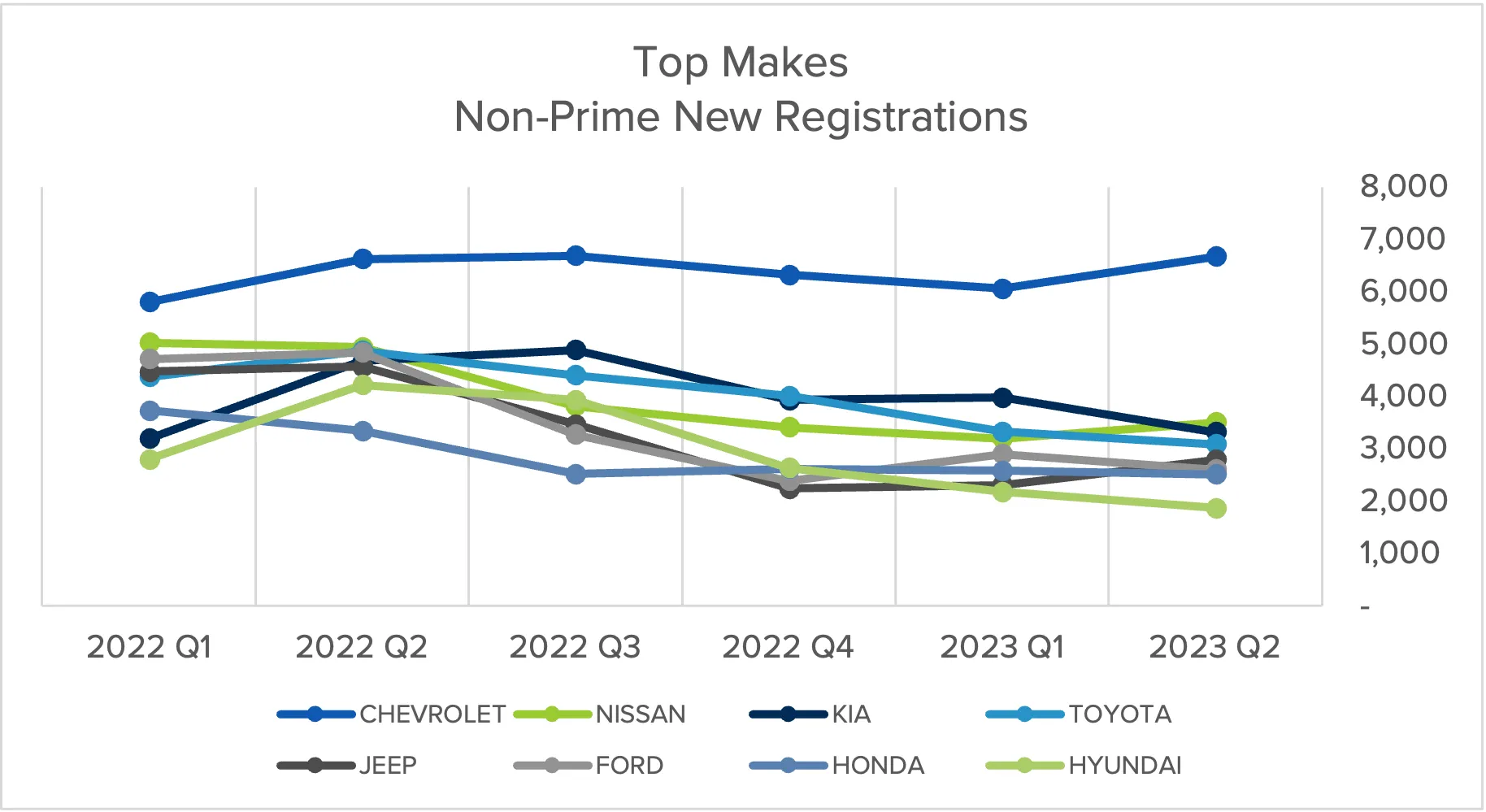

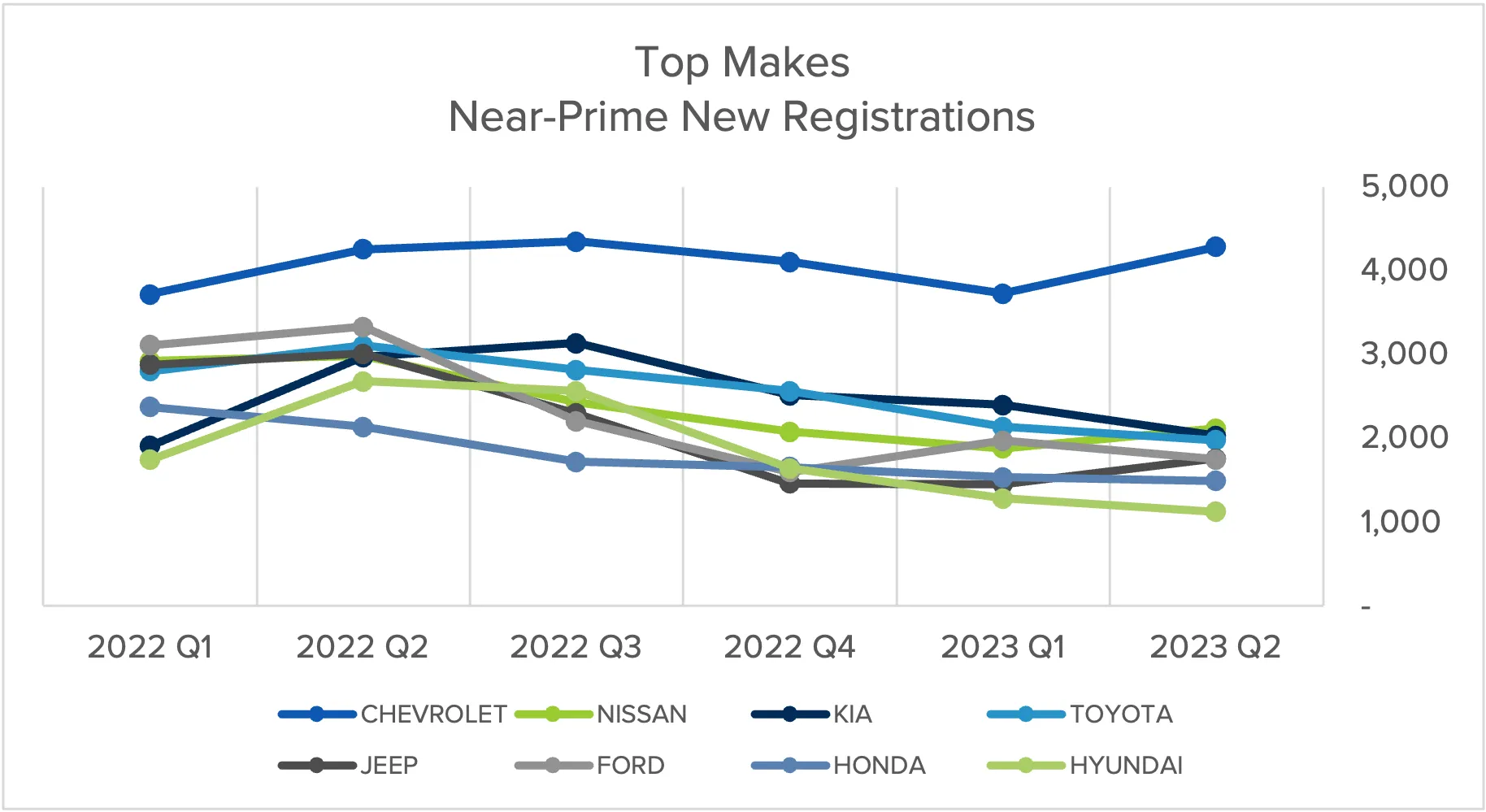

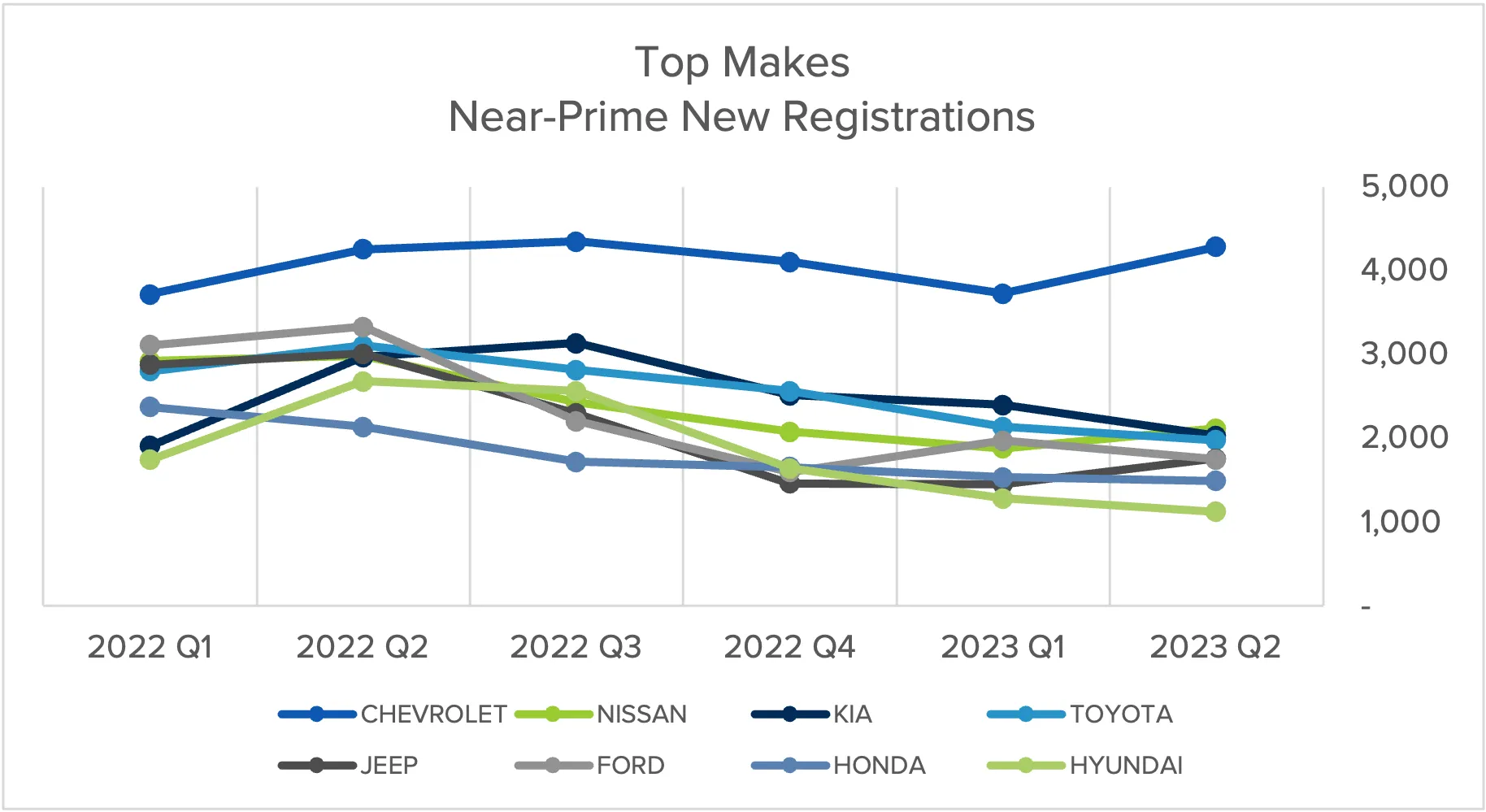

Near- and non-prime consumers consistently choose Chevy for their new car, purchasing 6,500 new Chevy models in the second quarter of 2023. Nissan was the second most sold new make for near- and non-prime borrowers, with just over 3,500 sold – slightly outpacing Kia (just over 3,322).

Source: Open Lending

While new Chevy registrations remain consistent, the other top five makers have experienced a steady decline, indicating an opportunity to strengthen efforts to reach near- and non-prime consumers in the new car market. In the second quarter of 2023, near- and non-prime new Chevy purchases were nearly double the number of Nissans, KIAs, or Toyotas.

Source: Open Lending

Chevy is also a top choice of new cars for prime customers. However, the margins among the top five choices are far slimmer, with Toyota and Ford also top choices for those in the prime credit tier. For example, in the second quarter of 2023, prime customers purchased nearly 14,000 Chevrolets compared to 10,000 Toyotas.

Source: Open Lending

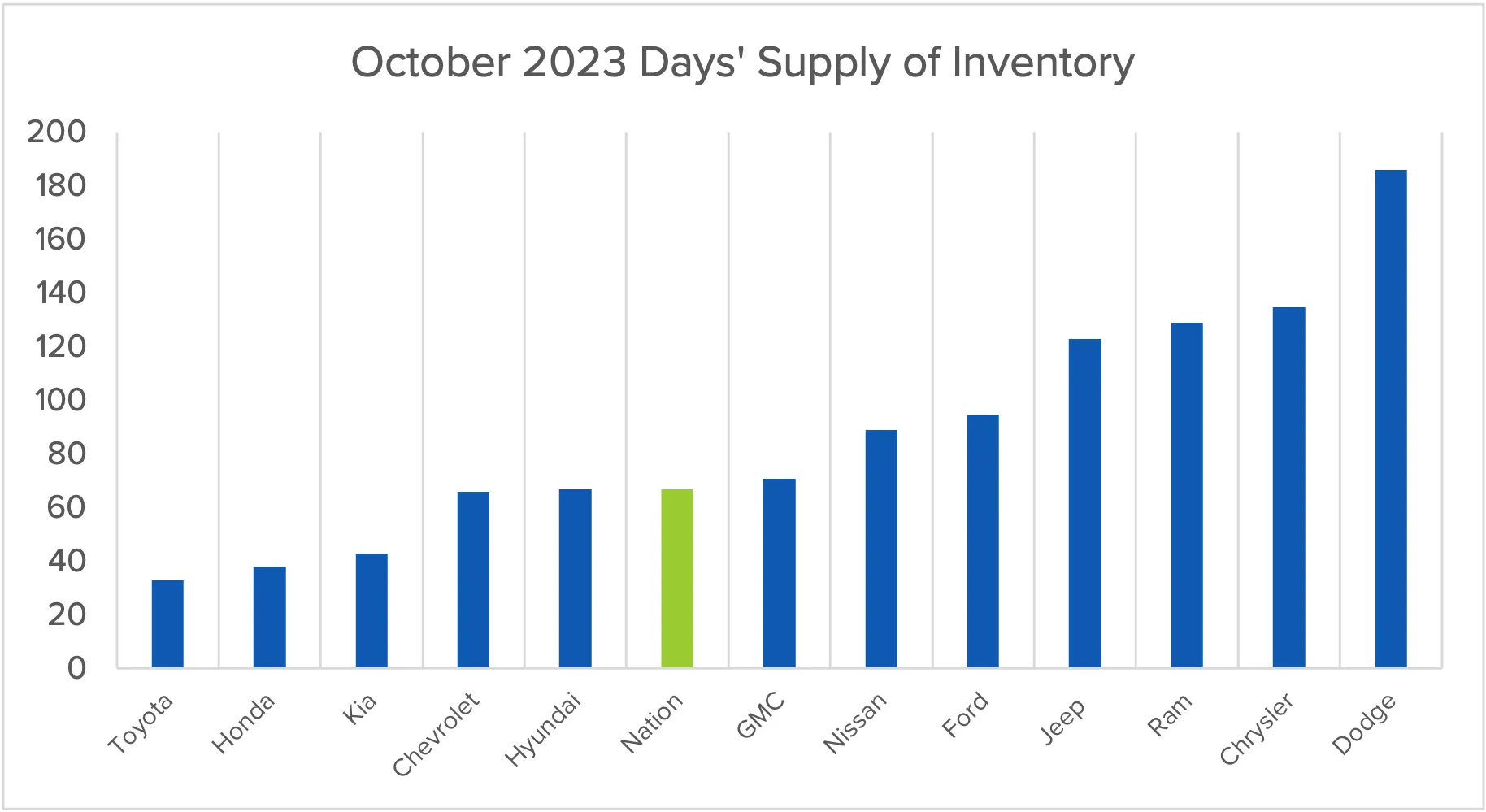

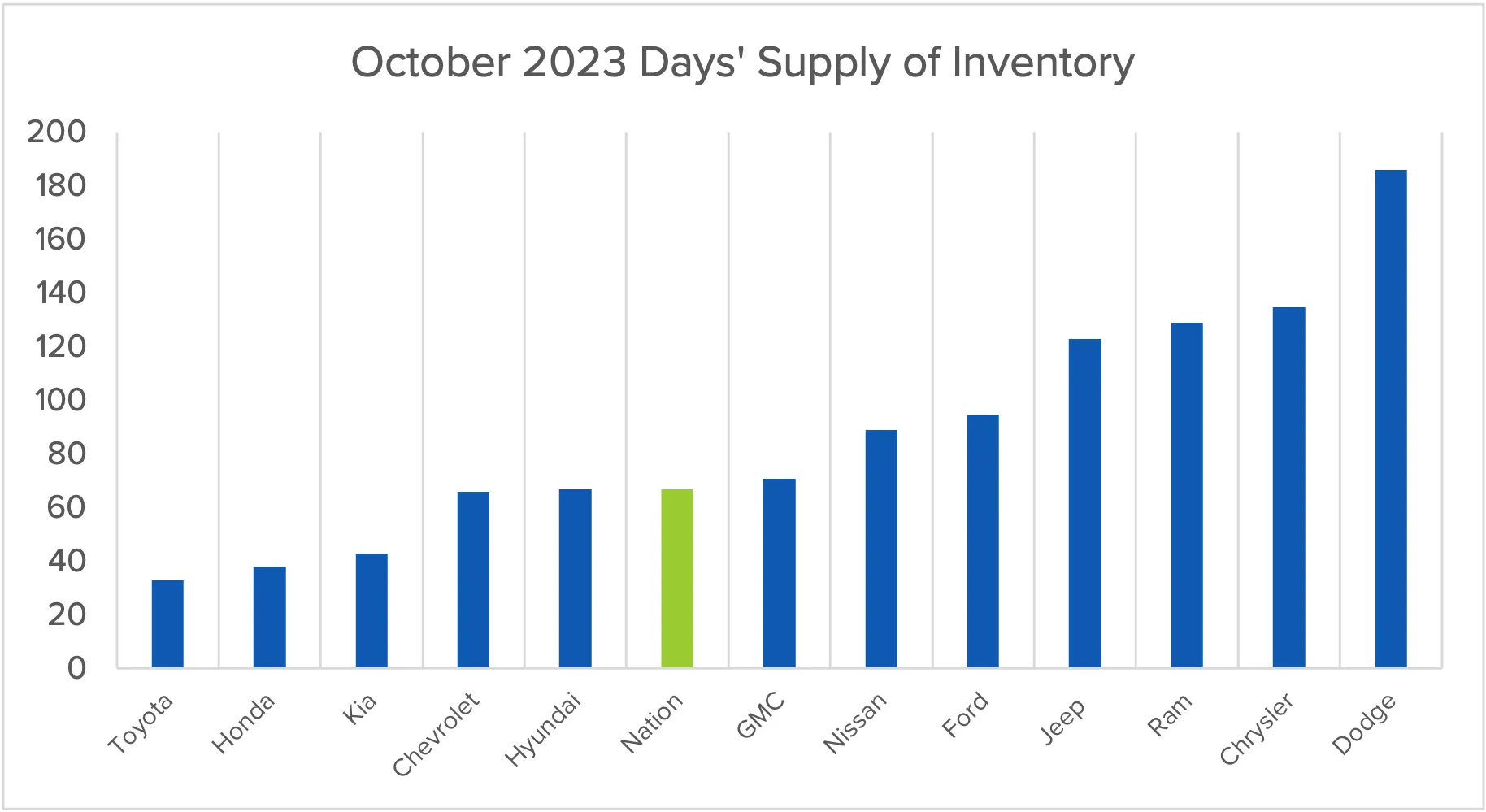

Concerns were raised about new vehicle inventory when the United Autoworkers initiated a strike in September 2023. Despite the strike, new vehicle inventory increased in November 2023 compared to October 2023. According to Cox Automotive, days supply jumped to 67 days in November from 60 days in October, and inventory was 41% higher year-over-year. The last time days of supply hit the 60 days was in March 2021.

Source: Open Lending

When comparing days of supply to near- and non-prime new make sales, supply seems to be exceeding demand. The data reveals near- and non-prime consumers overwhelmingly prefer Chevy when buying new cars, and readily available inventory with Chevy’s days’ supply of inventory was at 67 days in October 2023. Toyota had the fourth most near- and non-prime new car sales in the second quarter of 2023 and had the lowest inventory among brands at 33 days’ supply.

For Stellantis, which owns the brands with the top four highest days of supply (Dodge, Chrysler, Ram, and Jeep), trying to incentivize and reach near- and non-prime consumers may be beneficial to sell off excess inventory. With the UAW strike having ended, we expect that production will pick up quickly and already high days of supply numbers will only continue to grow.

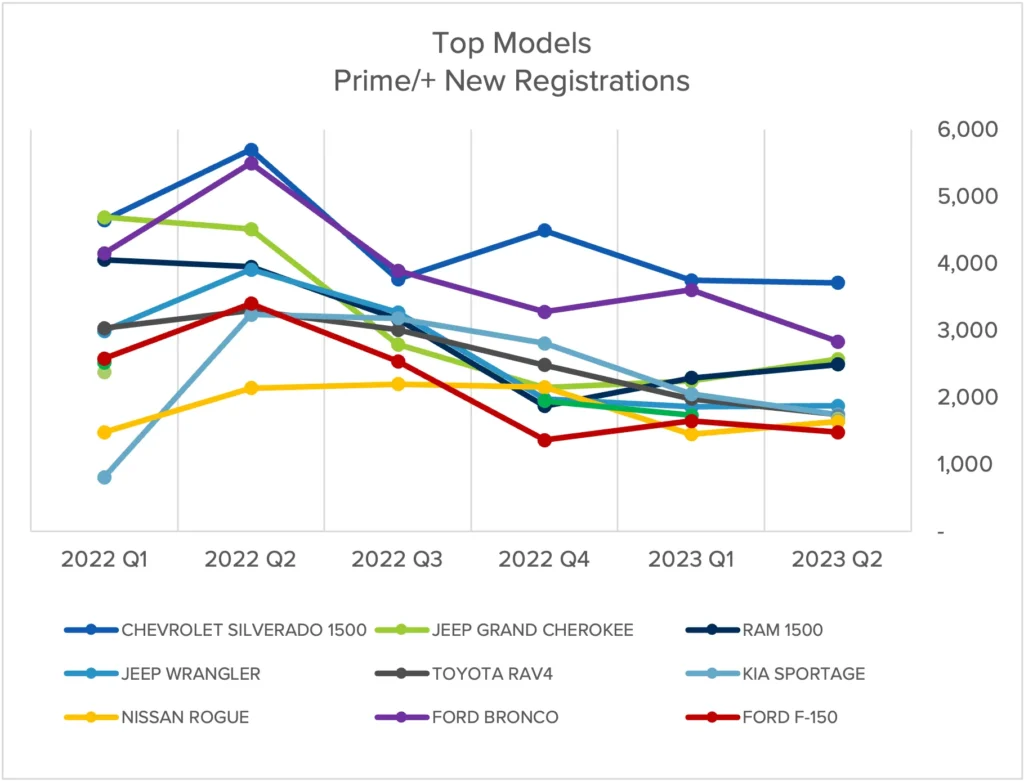

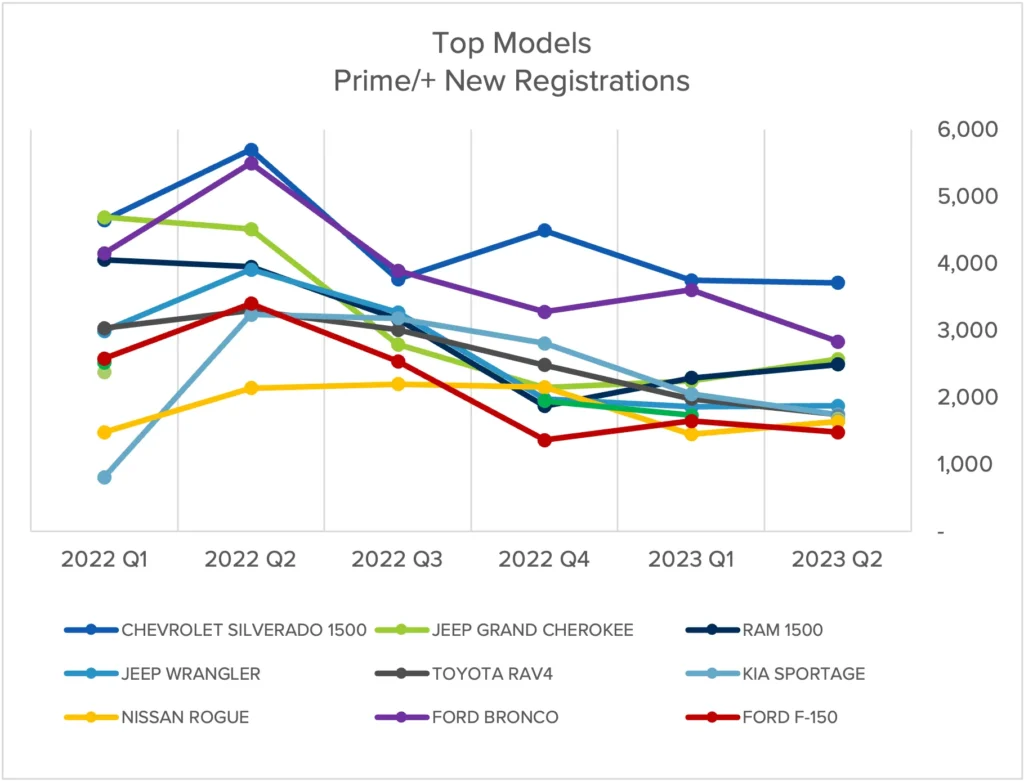

When looking at models, the Chevy Silverado 1500 dominates the new vehicle near- and non-prime market, with just over 1,550 sold in the second quarter of 2023. Because the Silverado 1500 is flexible and often used as both a personal and work vehicle, we predict that it will continue to be a popular option for near- and non-prime consumers.

Source: Open Lending

For prime new car buyers, the Chevy Silverado 1500 is consistently the most popular, with over 3,700 sold in the second quarter of 2023, with the Jeep Grand Cherokee coming in second with over 2,500 sold.

Source: Open Lending

When it comes to vehicle type, near- and non-prime consumers are narrowing their search to compact (nearly 6,000 sold in the second quarter of 2023) and upper-mid-size utility (nearly 5,000) vehicles when shopping for a new car.

Source: Open Lending

It’s important for OEMs to continue trying to reach near- and non-prime consumers. By doing so, they can reap the benefits of these borrowers becoming the prime and super-prime borrowers of tomorrow.

Analysis of credit migrations from before and during the COVID-19 pandemic found that near- and non-prime borrowers had the most upward mobility compared to other credit tiers. In fact, 43% of near- and non-prime borrowers moved to prime and super-prime tiers within 12 months. According to our latest Vehicle Accessibility Report (set to launch early in 2024), 69% of near- and non-prime borrowers plan to pay their automotive loan off early, and 77% have never missed or been late on a payment.

When you look at the total market, the Tesla Model Y is becoming increasingly popular. However, for near- and non-prime consumers, EV ownership and EV financing remain rare.

Source: Open Lending

It’s worth noting that there was a slight increase in EV registrations in the second quarter of 2023, and if this trend is sustained, it could signal that EV manufacturers are looking to reach beyond prime consumers. But thus far, EVs have not been as accessible to near- and non-prime consumers as other vehicles. While cost is the primary reason near- and non-prime borrowers often don’t consider EVs, the lack of infrastructure also contributes to inaccessibility. For example, a California state assessment found low-income communities have the fewest total chargers per capita, while high-income communities have the most. Additionally, homeowners are three times more likely than renters to buy an EV, possibly because homeowners have access to chargers in their own garages.

It’s important for automotive dealers to continue keeping an eye on EV sales and data, particularly when it comes to near- and non-prime consumers. Tailoring EV financing to this segment could incentivize a more diverse borrower base. Additionally, through expanding EV financing, the benefits of wider EV use can be realized.

Consumer preferences for used and new cars can present a significant competitive advantage for automotive lenders. When lenders know the makes and models most in demand, they can more effectively attract borrowers and ensure more accurate loan pricing and terms.

However, this data also paints a troublesome picture of near- and non-prime consumers being pushed out of the used and new car markets. Increasing interest rates negatively impact their ability to secure automotive financing, while those in the prime and super prime tiers have experienced little, if any, significant barriers to securing automotive financing.

These trends only exasperate the challenges near- and non-prime consumers have historically faced when trying to purchase a vehicle or secure automotive financing. But even as many financial institutions adopt stricter lending requirements, it is possible to expand your borrower base while mitigating risk and managing liquidity.

Lending Enablement Solutions modernize the lending process and can analyze a wider range of alternative data, identify creditworthy near- and non-prime borrowers and mitigate by generating a more accurate score. They also incorporate and analyze vehicle data. Interest rates, down payments, and loan durations should consider the car’s make and model.

These tools go far beyond traditional measurements of creditworthiness (e.g., FICO scores, institutional data, and proof of income) and use AI and machine learning to quantify alternative data sources and identify often-overlooked borrowers, including the prime borrowers of the future.

We have partnered with hundreds of financial institutions to help them meet their yield targets and profitability goals while serving a wider range of borrowers. By expanding how the industry assesses risk, we help automotive lenders remove barriers facing near- and non-prime borrowers while staying resilient and profitable regardless of economic tailwinds.

Find out more about the growth opportunities Lenders Protection provides.

Insights presented in this report are sourced using proprietary data from Open Lending as well as TransUnion and S&P Global’s AutoCreditInsight™.

ShareAll fields required

"*" indicates required fields